Lebanon’s untapped tourism potential, what the country can learn from Jordan’s success and the need for a joined-up approach when it comes to marketing and messaging were among the topics that Hospitality News asked industry experts to expand upon following their participation at a high-profile, sectoral event recently in Beirut. Here’s what they said…

Held on April 16 under the banner ‘Lebanon Tourism Sector: Driving Growth and Building Resilience’, the seminar was organized by the Lebanon Enterprise Development (LED) Project and funded by the United States Agency for International Development (USAID), in collaboration with the UN World Tourism Organization (WTO), TripAdvisor and the Global Travel and Tourism Resilience Council. More than 200 representatives from Lebanese businesses, associations and stakeholders based in the tourism sector came to hear keynote speakers explore a broad range of topical issues, such as the out-of-season challenge and how to counter negative perceptions of safety and security, with a view to creating outward marketing plans. The number of international tourists visiting Lebanon has risen in recent years, supported by the government’s Visit Lebanon marketing campaign, which was launched in May 2017. Figures show that visitor numbers rose 5.7 percent in 2018 to 1.96 million, with an industry report by TRI Consulting titled Shifting Sands The Middle East Hotel Market – 2019 citing European arrivals as up by 10.3 percent year-on-year (y-o-y), even though regional and domestic political instability remain a concern for some source markets.

Safety: perceptions and misconceptions

Security and the perception of safety that tourists have of a destination when making their travel plans was a key theme at the seminar and one that drew mixed responses from the industry leaders that HN interviewed. Ibrahim Osta, director, Chemonics International, and international tourism expert, described Lebanon’s low ranking on the security index of the 2017 World Economic Forum (WEF) Travel and Tourism Competitiveness Index as “grossly unfair”. The country placed 125 for security out of 136 destinations. “We all know Lebanon is stable and safe, safer in fact than most destinations in the world,” he told HN. “Not all destinations allow a visitor to walk at 3am without fear of crime, violence or mugging, but market perception can be a consumer’s reality.”

However, Al Merschen, partner, MMGY Global, and international travel industry specialist, acknowledged that travelers from the US market remain largely cautious about visiting Lebanon. “Most people still have a concern about security,” he said. “Everybody asks if it’s safe and that’s the biggest hurdle that Lebanon has to overcome.”

Justin Reid, director of Destination Marketing, Europe, Middle East & Africa at TripAdvisor, took a different view, saying he believes times are changing. “Concerns about Lebanon are certainly less than they were a few years ago,” he said. “The overall perception is that terrorism is less of an issue – that it has instead become an export, with tragedy experienced everywhere. When people ask questions about safety on TripAdvisor, 99 out of 100 respondents tell them they are safe.”

Communication: sharp and smart

All three industry leaders felt that marketing has a key part to play in raising Lebanon’s profile on the international stage, from easing safety concerns to highlighting the country’s attractions. “Most people don’t realise the diversity Lebanon offers as a destination or how close everything is and I’m including myself before I visited,” Merschen said. “I knew there were mountains, for example, but I had no idea about the snow you get there, and although I’d heard about the nightlife, I didn’t know there was so much going on outside of Beirut.”

Osta agreed that although Lebanon possessed all the necessary ingredients for positioning itself as a lucrative, higher-end destination, success depends on relaying its attractions effectively and via the right channels. “Better communication with the marketplace based on a clear strategy, a sharp brand message and positioning with higher-value travelers will yield desired benefits of arrivals and spend,” he said. “An increased focus on smart communication, utilizing digital media, and an integration of effort among members of the industry for joint action is important to this.”

Niche not mass

He was also adamant that Lebanon should avoid mass tourism, saying carefully selected market segments that would appreciate and be willing to pay for high-quality and distinguished experiences was the way forward. “This means targeting higher-earning visitor profiles that are segmented based on their travel motivations,” he noted.

Osta said Lebanon’s many strengths, which include its array of cultural and natural attractions, vibrant night scene and renowned cuisine, made it a choice destination for high-value travelers, although he noted that seasonality remains an issue. “Most arrivals come between April and September, peaking in July,” he said. “The richness and diversity of Lebanon’s regions and tourism product allows for increased arrivals in the shoulder and off seasons to minimize sharp declines.”

Niche markets such as the MICE segment not only hold untapped potential but could also help boost occupancy levels out of season, according to Osta. “MICE travelers are generally higher spenders than leisure travelers and they often return as leisure visitors with their families,” he said. Osta also suggested that more could be done to boost the number of people visiting tourism sites by making them a better draw.

Persuading visitors to stay for longer is another target area that certainly merits focus, according to Reid. “For example, when you have an influx of people for an event such as the Beirut Marathon, the question to ask is: how can those short stays be transformed into week-long visits? Tying them to other attractions, such as pampering spas or walks is certainly worth exploring. The idea is to turn something that’s already big as a short visit into a longer one that’s great.”

Cohesion is key

Reid highlighted the “fantastic” activity-based trips that smaller tour operators were offering visitors in segments such as mountain-biking and hiking, but added that they could be marketed much more effectively if a joined-up approach was adopted. “To me as an outsider, it seems that there’s some really good stuff going on, but it’s all a bit disjointed, with the associations not quite working together which is a shame as the tourism offering is really vibrant,” he said. “I think greater cohesion from the top is needed to cut through to the next level. It’s about getting organized internally and coming up with a policy to get those messages out with one voice to the international tourism pool.”

Merschen agreed that the operators within the industry were not only delivering strong performances but keenly aware of the need to raise the country’s profile effectively. “Sometimes you find the passion but not the product or professionalism, but that certainly wasn’t the case in Beirut,” he said. “I found a great level of professionalism and sophistication. They get it and are looking for the leadership to create a funded, long-term global marketing strategy.”

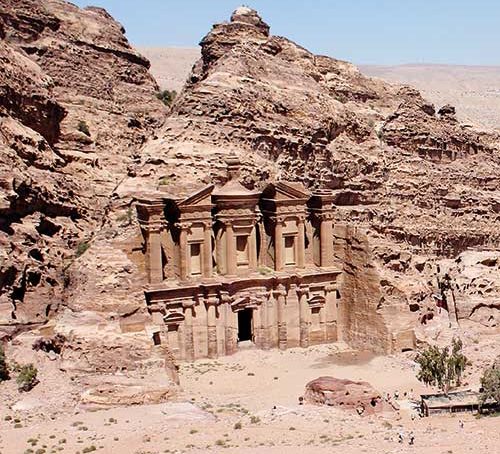

Jordan’s success story

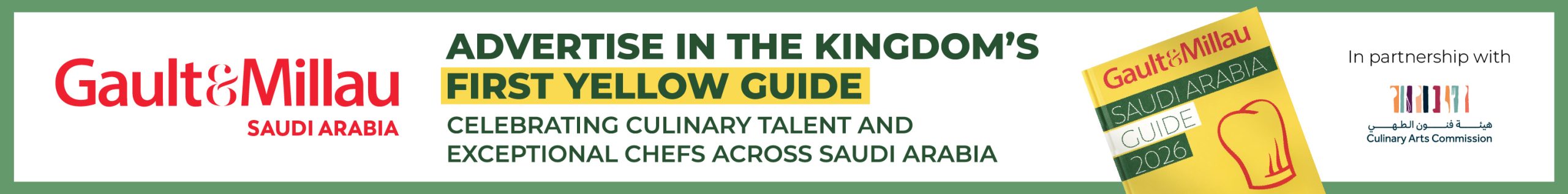

Creating an effective and cohesive policy that presents its offering to partners via a unified approach has enabled Jordan to develop its tourism industry with successful results. According to TRI Consulting’s report, Jordan witnessed growth in visitor numbers from Europe, Asia and the Middle East last year, with the BAR and corporate segments the key driver of demand in Amman, closely followed by the leisure and conference segments. “Jordan does a very good job of capitalizing on its attractions, whether it’s Petra and the Dead Sea or filming blockbusters, which has positioned it many years ahead of Lebanon in how its tourism offering is organized,” Reid said. “These efforts are reflected in TripAdvisor’s figures, which showed that in 2018, Jordan had the third-biggest year-on-year growth for a destination of 11%. The challenge for Jordan is to keep on doing what it’s doing.” Osta said given the challenges Jordan had faced due to its location in an unstable region, its record-breaking achievements were certainly impressive. “The country worked actively to dispel market misperceptions and the tourism trade, the Jordan Tourism Board and the Ministry of Tourism and Antiquities, crafted a strategy supported by USAID to present Jordan as an attractive and stable destination,” he said. “The results are clear and tourism in Jordan is booming and in fact setting historic records.”

Managing demand

He added that the challenges for Jordan today were not so much a lack of tourists as the industry’s ability to deliver on the brand promise of a memorable experience and turn visitors into ambassadors by maintaining the required level of quality in the face of an influx of arrivals.

Osta also highlighted the importance of looking after the country’s many antiquities and cultural assets. “Success calls for vigilance,” he cautioned. “Petra is setting new records for arrivals and will well exceed the 1-million-visitor mark this year. As a fragile UNESCO World Heritage site, these numbers are a reminder of the importance of ensuring the site is properly conserved and visitor flow is well managed.” There was all-round hope that Syria would one day return to its former glory as a popular destination with a wealth of attractions amongst travelers. However, it was universally acknowledged that the country was unlikely to be visitor-ready for several years and only after major investment.

Ibrahim Osta

Director

Chemonics International

Al Merschen

Partner

MMGY Global

Justin Reid

Director of Destination Marketing

TripAdvisor

MARKET OUTLOOK AMMAN

Source: TRI CONSULTING

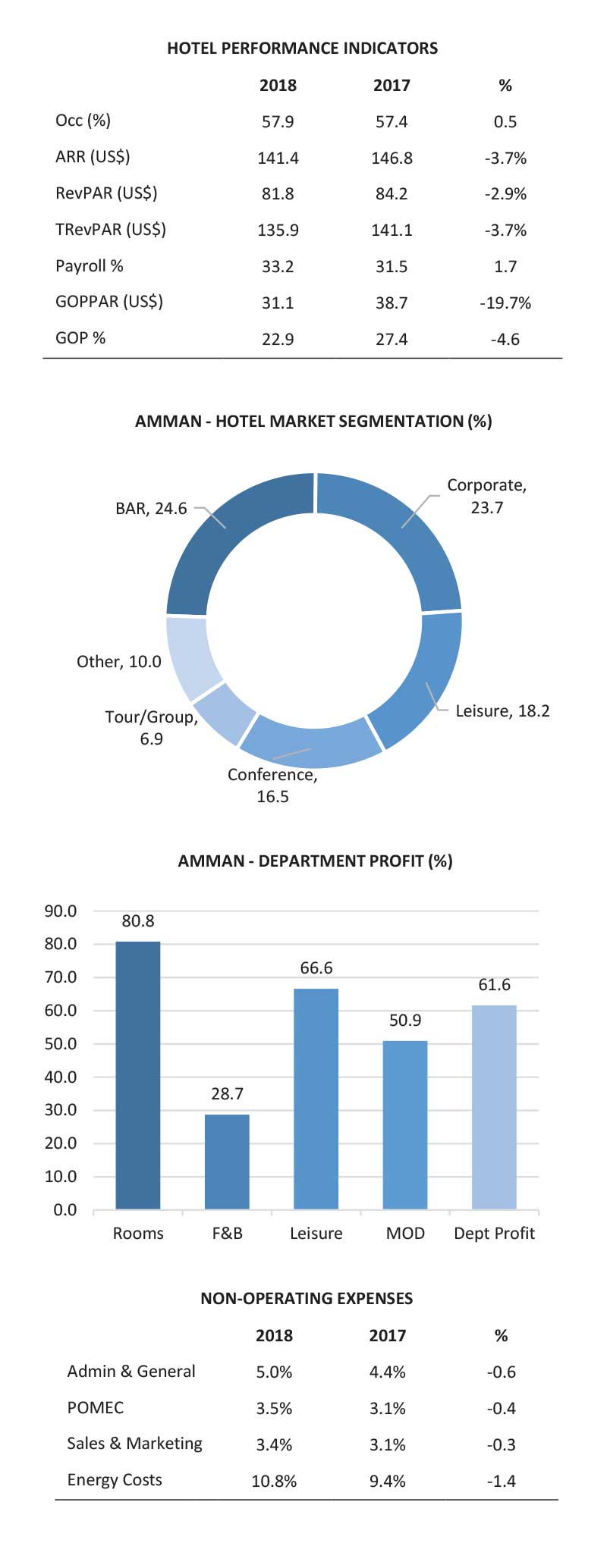

MARKET OUTLOOK BEIRUT

Source: TRI CONSULTING

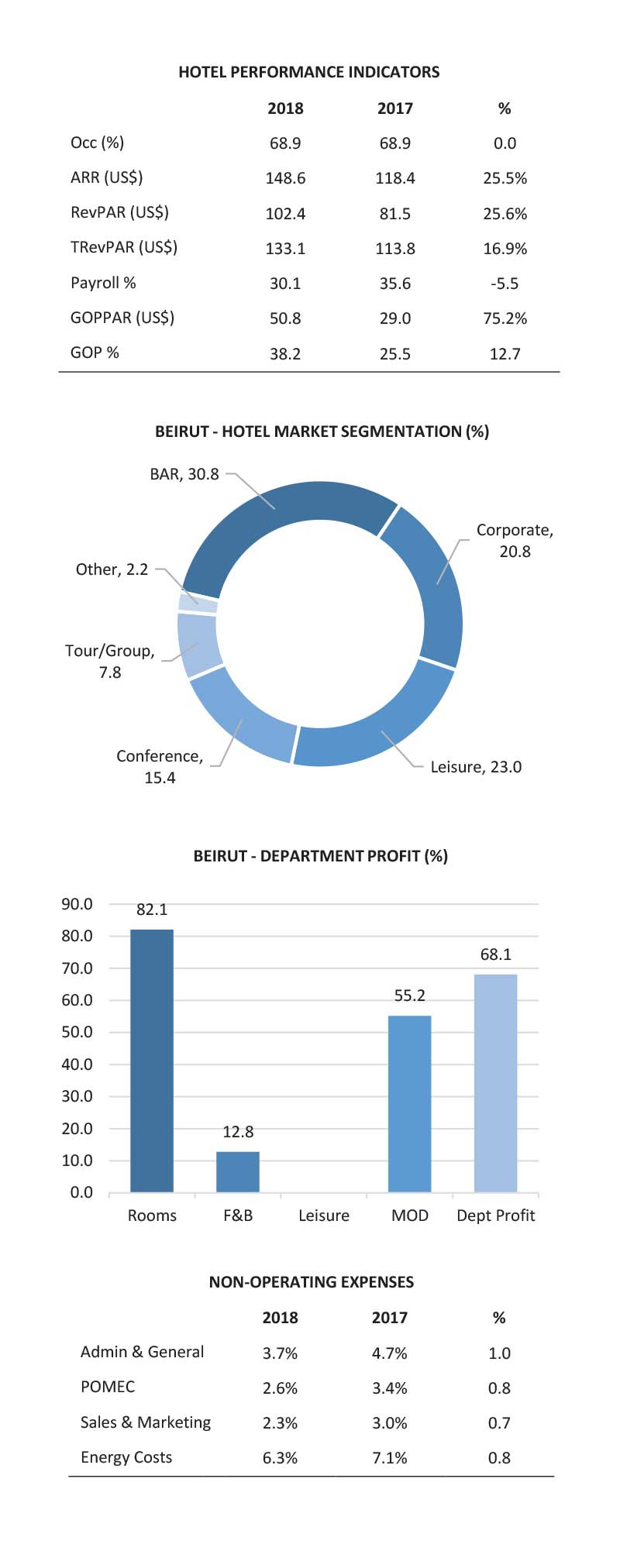

ANNUAL GROWTH IN LEBANON VIEWS BY MARKET

Source: Tripadvisor

Out of the top 20 countries viewing Lebanon The Netherlands, Italy and India showed especially strong increased views of Lebanon

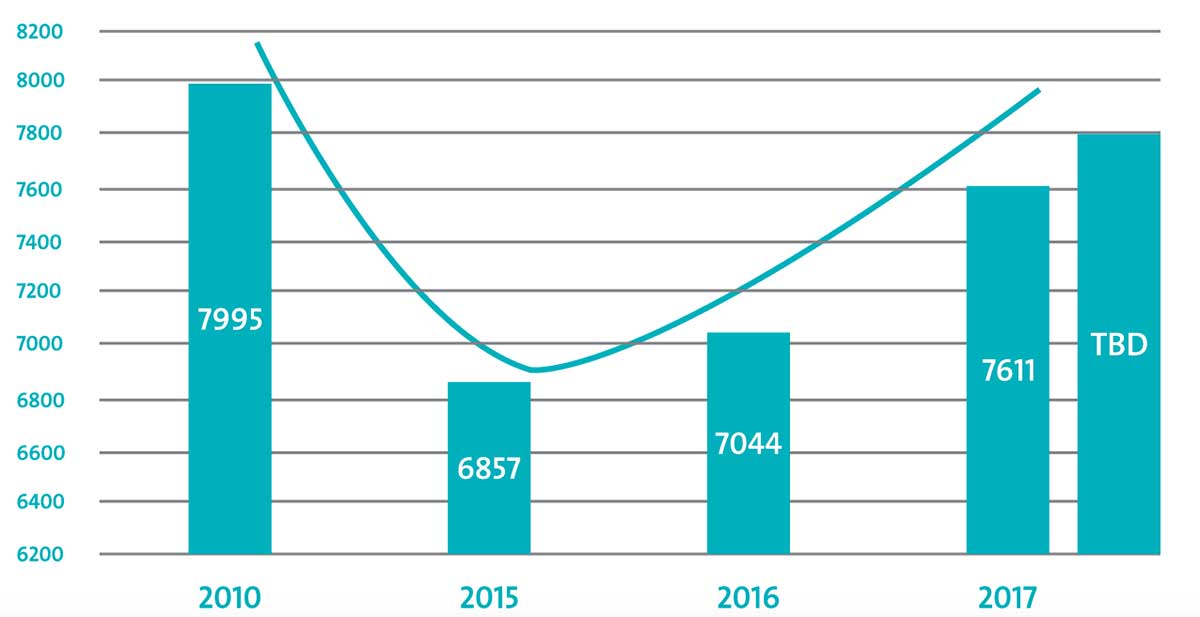

LEBANON’S INTERNATIONAL TOURISM RECEIPTS (MILLION USD)

Source: Chemonics International

Downtown Ravaged International Receipts

Receipts lag arrivals rebound

Visitor spend is lower

$5.5 Billion in 2005

AROUND 2018 INFLATION-ADJUSTED REAL RECEIPTS