It’s an interesting year for the travel industry; on one hand, restrictions have eased and pent-up demand has been unleashed; on the other, the sound of war echoes across Europe, while global inflation thwarts growth and threatens a worldwide recession. Amid these opposing market forces, understanding post-pandemic sentiment and the behavior of travelers can, at times, feel like an insoluble enigma. However, STR’s latest Consumer Insights Survey, conducted in July/August 2022, has attempted to decode the mystery.

Accommodation preferences

With seasonality playing a role, hotel accommodation remained the preferred choice for travelers, even though short term rentals and staying with friends and family both showed an increase in STR’s July survey. When compared to pre-pandemic figures, short-term rentals and hotel stays continued to be the most dominant accommodation type, with hostels seeing a significant decline in interest. The shared nature of facilities and limited personal space are likely factors that continue to negatively impact hostel-like accommodation.

Within the hotel segment, full-service and smaller properties featuring less than 50 rooms have seen the greatest increase in interest from consumers, with branded hotels often being chosen over their independent counterparts.

However, around 40 percent of respondents said that Covid-19 has not changed their hotel preferences.

Travel sentiment

Fueled by travel disruptions, cancellations and mountains of lost luggage mainly across Europe in the early summer, international travel sentiment largely remained in negative territory. Airlines and airport facilities struggled under the wave of pent-up demand as summer holidays began.

Travelers are showing a clear preference for countryside and beach getaways, as city breaks seem to have fallen out of favour compared to the pre-Covid-19 times. Travel aspirations for British travelers continued to lag behind North Americans and Europeans, with UK consumers showing a strong preference for domestic trips over international ones. With the continued devaluation of the British pound, the affordability of overseas travel is becoming a concern.

On the other hand, Americans are finding European destinations more affordable than ever before due to the exchange rate alone.

Business travel

Business travel has been hit harder than leisure, with full recovery not expected until the pandemic is fully behind us. Business travel to meet suppliers and vendors abroad is most likely to drop in the future, while trips to in-person events has been least affected. Although corporate travel managers are likely to budget higher for 2023, economic headwinds may result in shorter trips or downgrades in accommodation. However, the good news is that business travel will not disappear, as anticipated during the pandemic, with 46 percent of survey respondents expecting to travel for business in the next 12 months.

Cost of travel

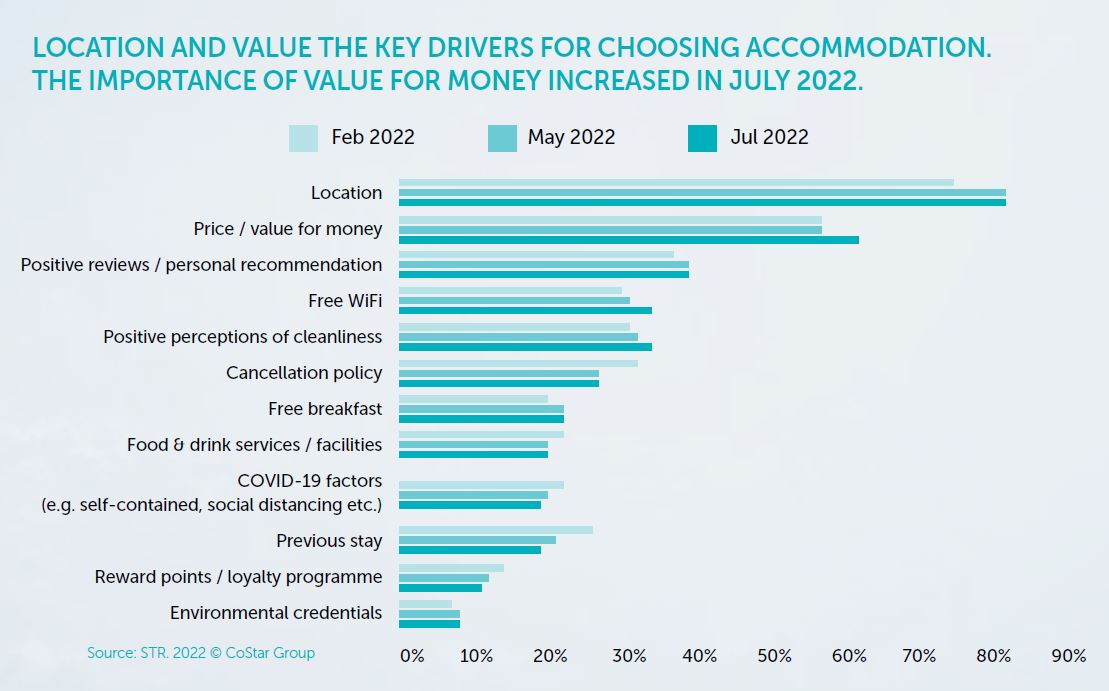

The knock-on effect of record inflation combined with an energy crisis, amplified by the war in Ukraine, is also affecting the travel industry. Even though global travel demand has not fully returned to 2019 levels, prices in most cases are much higher than expected. In uncertain times like these, it comes as no surprise that value for money is becoming an increasingly important factor in travelers’ decisions to book trips, as illustrated in STR’s survey. While location has always been the top accommodation influencer, value for money is a facet that both travelers and accommodation providers need to find common ground on in the post-pandemic economy.

Looking ahead, consumers anticipate the steepest increases to affect transportation, followed by food and beverage, and accommodation. Expectations and reality seem to concur, with the consumer side prepared to pay more while the travel and hospitality industry continues to increase prices.

Although it is encouraging to see the return of travel, with the influence of Covid-19 ongoing uncertainty. While demand momentum is still a key driver of recovery, travel remains highly sensitive to any sudden changes in these volatile times.

Kostas Nicolaidis

Middle East & Africa Executive

STR