Top line hotel performance in the Middle East is heading towards its fifth year of continuous decline. Kostas Nikolaidis, Middle East & Africa executive for STR, navigates the choppy waters of the current hospitality market

Meanwhile, Africa, the final frontier of hotel development according to many, has operated at two speeds, with Northern Africa rebounding and pacing ahead of Southern Africa overall. It therefore comes as no surprise that hotel profitability for the region as a whole has also come under pressure and in fact has been declining since 2015. We drill down into the fundamentals of hotel profitability for Dubai and Beirut as analysed in STR’s Hotel Profitability Study 2019.

Dubai

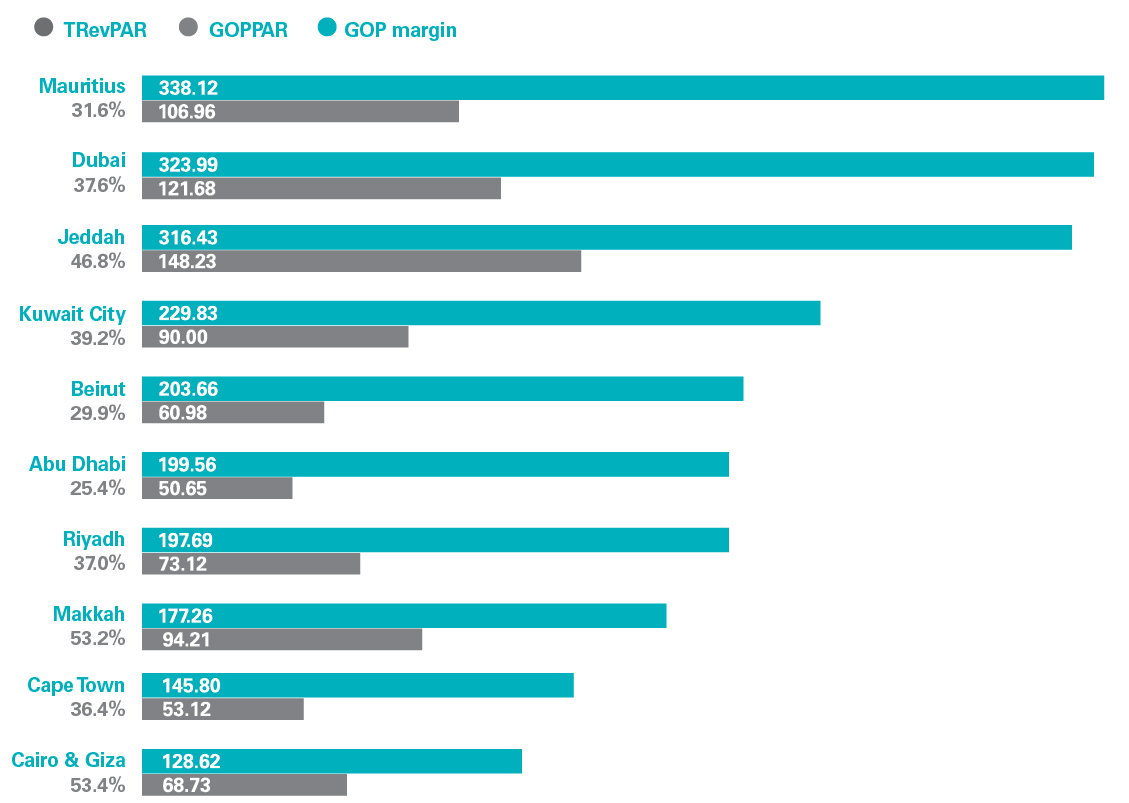

Multiple factors have influenced Dubai’s consistent hotel profitability decline over the past few years. To name just a few, the accelerating new hotel supply ahead of EXPO 2020, which resulted in increased competition, as well as the rebalancing of key source markets with ever-increasing inflows from Asia, particularly China. These have affected hotel rates and subsequently, profits. TRevPAR in 2018 declined for the fourth year (-0.3% drop to AED1,190). While Rooms Revenue continued on a downward trend with a 2.7% decline, F&B only dropped 0.5%. Since F&B makes up 35.7% of Total Operated Revenue in Dubai, even a slight drop significantly affected certain profitability metrics. Despite hoteliers’ cost control efforts, Total Departmental Expenses decreased at a slower rate than revenue, thus, impacting Departmental Profit (-2.7%). The combination of those factors pushed 2018 GOPPAR down to AED446.91 (-3.2%). Nevertheless, Dubai GOPPAR still remains pretty much at the top of the MEA region and with a healthy GOP margin of 37.6% as the chart accompanying this article suggests.

Beirut

Given Lebanon’s status as a popular leisure destination in the past, the travel ban imposed by Saudi Arabia and the UAE in 2017 affected it in 2018. This most notably manifested in a significant decline in F&B Revenue (-11.7%) that drove a 3.1% drop in TRevPAR, while Rooms Revenue and Other Operated Departments Revenue recorded slight growth of 1.1% and 4.4%, respectively. Hoteliers were quick to react by cutting costs, which helped counter the decline in the F&B department and mitigated the impact on Department Profit (-1.1% vs. TRevPAR decrease of 3.1%). Total Departmental Expenses dropped 6.2%, primarily due to a double-digit drop (-11.1%) in F&B expenses. GOPPAR decreased by 4.9% in 2018, partially driven by growing Total Undistributed Expenses (+2.8%). As a result, Beirut hotels operated at a relatively subdued 29.9% GOP margin. With the travel ban from Saudi Arabia now revoked earlier in 2019, Lebanon has regained access to the biggest outbound tourism market in the GCC with performance rebounding so far.