2018 was a bruising year for hotels in the Middle East & North Africa, as an intersection of oversupply, political fallout and macro-economic worry challenged profitability.

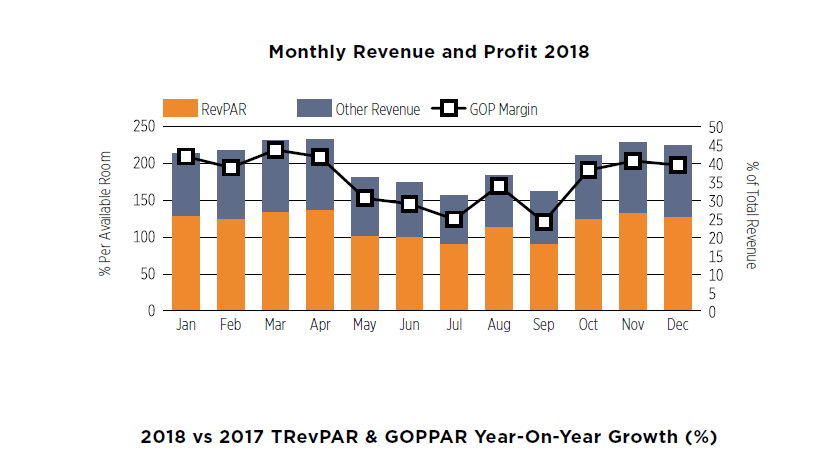

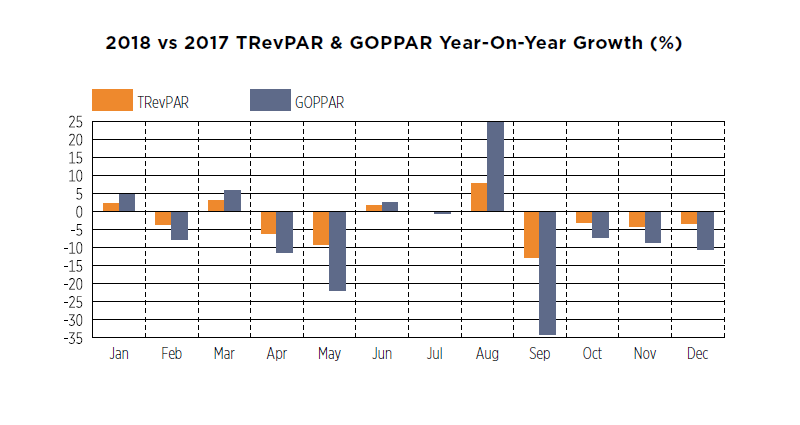

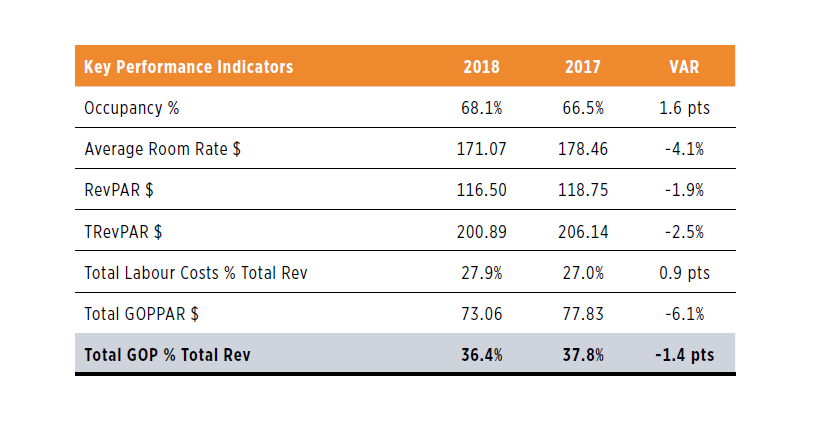

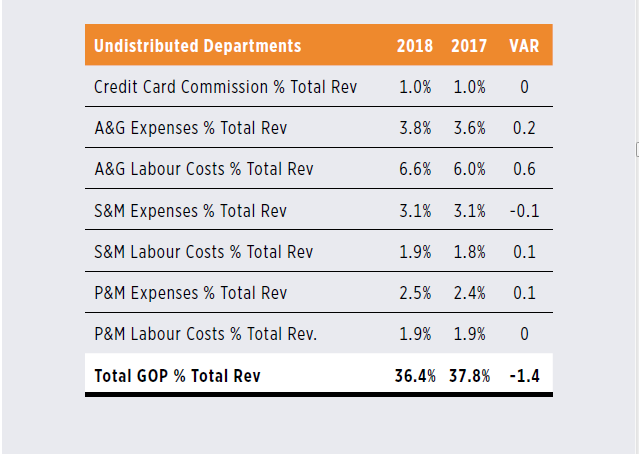

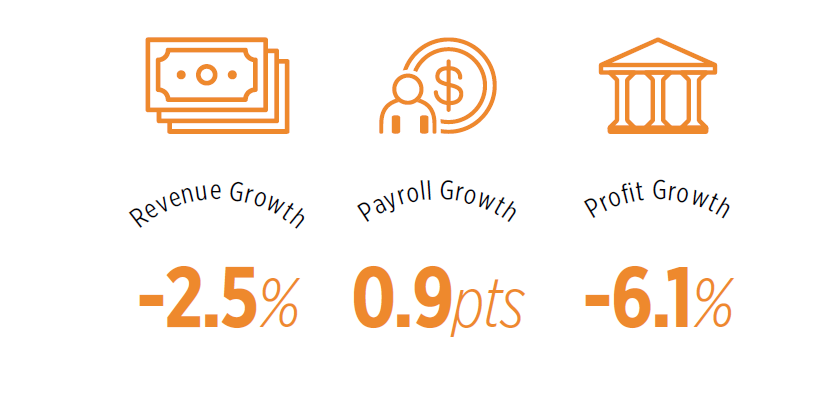

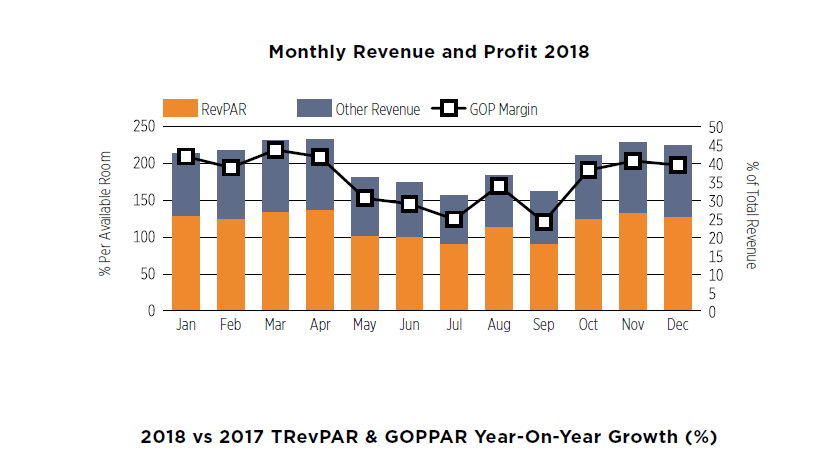

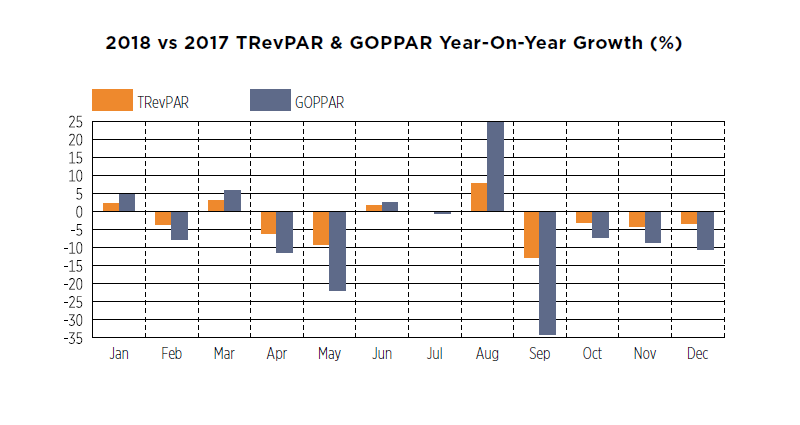

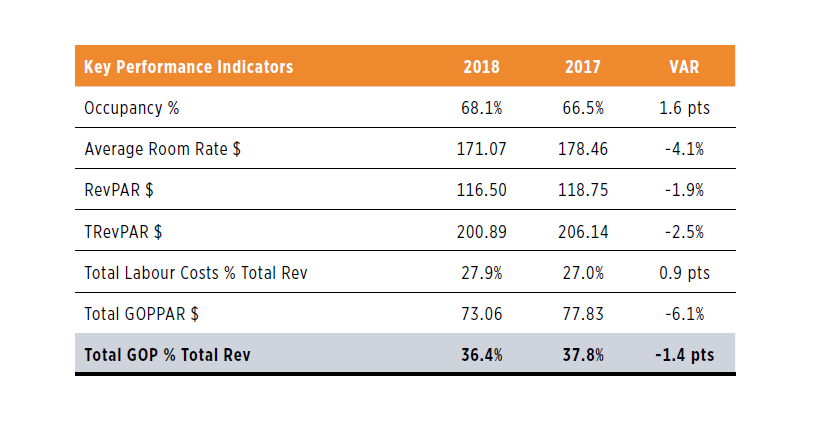

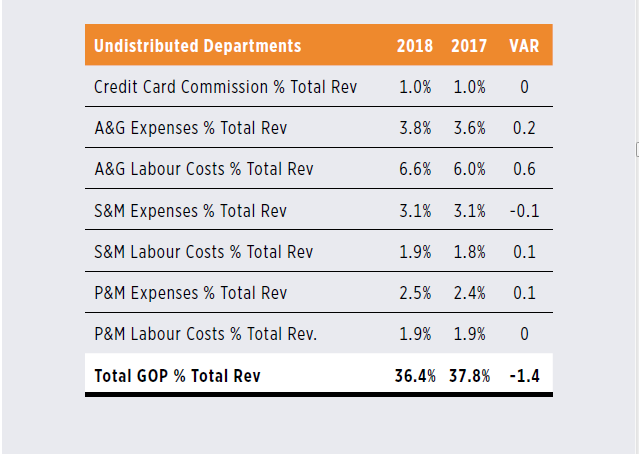

Across the region, year-over-year GOPPAR was down and has been on a steady decline since early 2016. YOY profit growth was down 6.1 percent in 2018 over 2017, while profit margin dropped 1.4 percentage points to 36.4 percent.

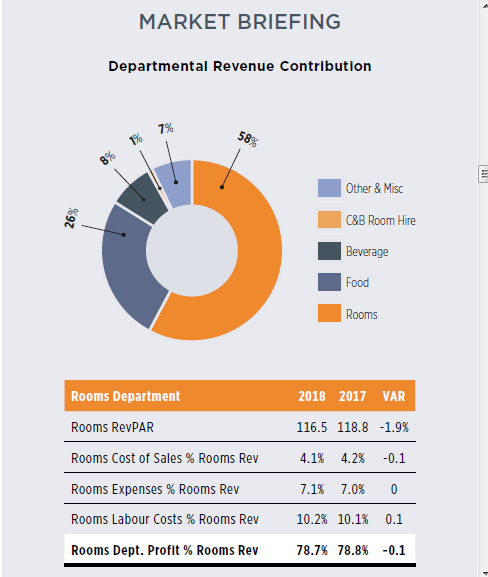

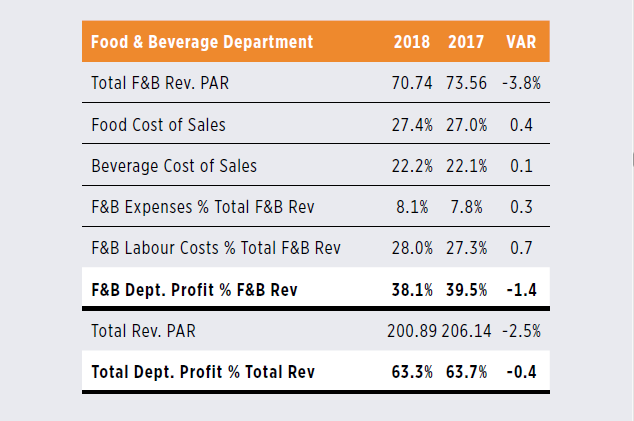

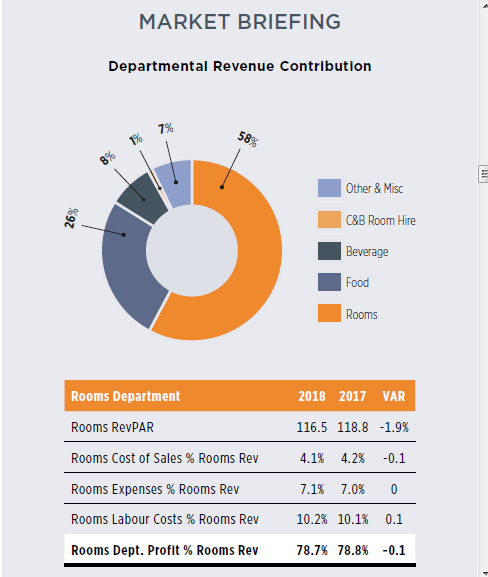

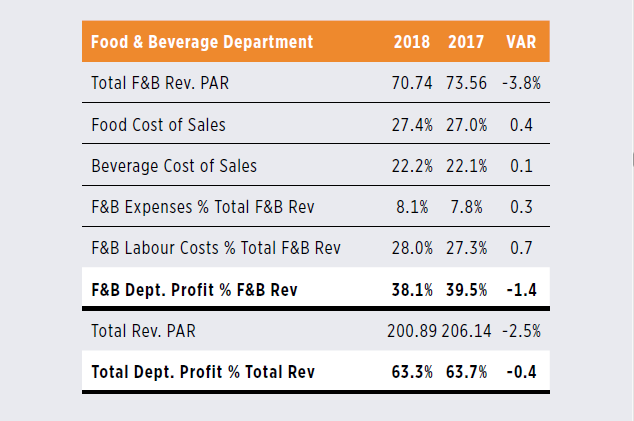

Profitability woe stemmed from trouble on the top line, where, while occupancy was up 1.6 percentage points to 68.1 percent, average room rate decreased 4.1 percent YOY, leading to a 1.9-percent YOY decline in RevPAR to $116.50. And while the rooms department was a source of consternation, so, too, was the food-and-beverage department. Total F&B RevPAR was down 3.8 percent YOY and food cost of sales and beverage cost of sales grew 0.4 and 0.1 percentage points, respectively.

A listless top line in both rooms and F&B led to a 2.5-percent YOY fall in TRevPAR to $200.89.

Expenses were up moderately, but difficulty growing the top line made them stand out even more, impeding operators’ ability to flex cost. Total hotel labour costs on a per-available-room basis were up slightly at 0.2 percent YOY, but total hotel labour costs as a percentage of total revenue were up 0.9 percentage points, suggesting that while hoteliers did a fine job of containing cost, revenues were not high enough to absorb the rather minimal rise.

On the other hand, utility costs on a peravailable- room basis were actually down 0.5 percent YOY, but those expenses as a percentage of total revenue rose 0.2 percentage points. Meanwhile, A&G and P&M expenses were also up slightly, while S&M expenses were actually down 3.3 percent YOY and flat as a percentage of total revenue. It’s clear that the region’s problems stemmed from growing revenue and not cost control, with the former being impacted by events such as stagnating oil prices and a glut of new supply in some of the regions most-traveled areas.

Meanwhile, localized political impacts, such as a boycott of Qatar, instituted by Saudi Arabia, the UAE, Bahrain and Egypt, over accusations that the Gulf state financed terror, have had a significant effect on inbound tourism.

Oversupply is also causing pricing issues. Consider Dubai, which has a surfeit of new hotels. However, many prognosticators believe that new supply will be further absorbed ahead of, and with the help of, Expo 2020.

New hotels expected to open in Dubai for Expo 2020 include the SLS Dubai Hotels & Residences. Expo 2020 runs between 20 October 2020 and 10 April 2021. While the operating environment in North Africa is equally challenging, countries like Egypt are on an upward trajectory, rebounding due to an improved security apparatus after terrorism events that hampered tourism.

Hoteliers in 2019 and forward will seek to continue their adroit cost control, while, with the hope of an uptick in travel to the region, maximize revenues to increase the bottom line.

The read the full PROFIT MATTERS: MENA Annual Hotel Performance Tracker 2019 report click here: hotstats.com

Add to Favorites