Tough trading conditions have been the norm for the Middle East hotel industry over the past five years. A drop in oil prices that began in 2014 inevitably led to an economic slowdown for oil-dependent countries, including Bahrain. Kostas Nikolaidis, Middle East & Africa executive for STR, tracks the kingdom’s early stages of revival and shares his thoughts on where it goes from here

Despite the country’s diversification into sectors such as finance, manufacturing and tourism, oil has proven to be a key driver of the kingdom’s hotel performance. This time though, that dependence has produced positive results.

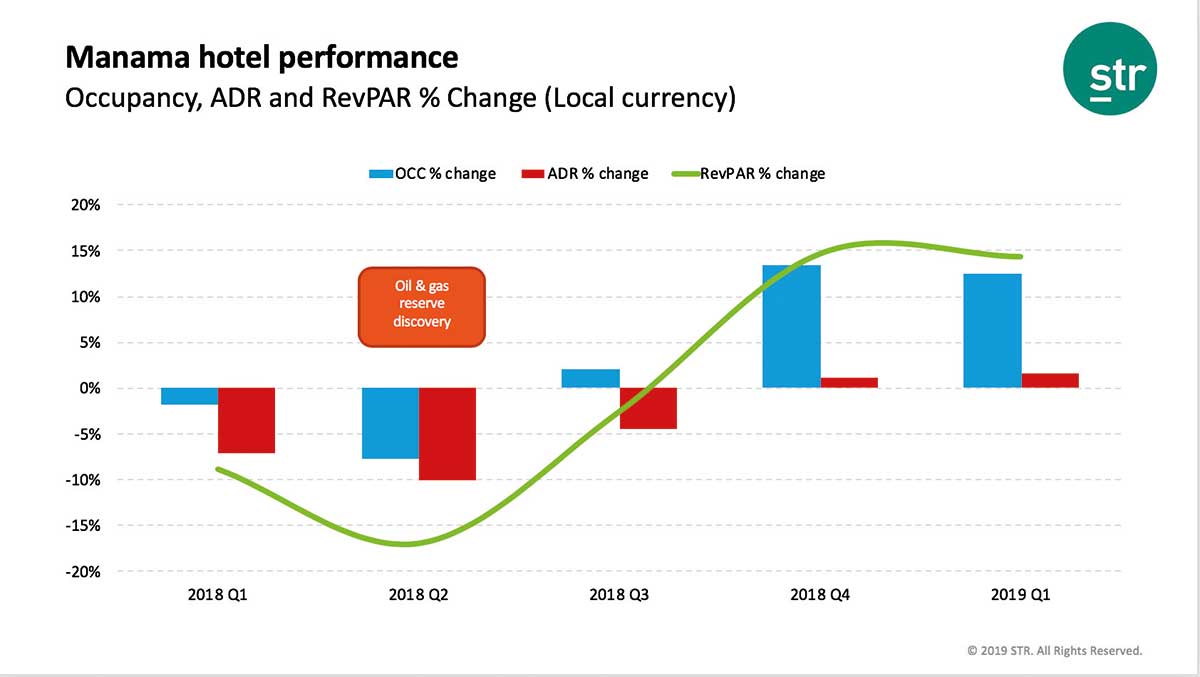

In April 2018, Bahrain discovered a new and significant oil and gas reserve off of its coast. Since that announcement, previously declining hotel performance in the nation’s capital has started to rebound. Corporate business has returned, allowing Manama hotels to record year-over-year revenue per available room (RevPAR) gains of 14.7 percent in Q4 2018 and 14.3 percent in Q1 2019. As the accompanying graph shows, the growth has mainly been fueled by increases in occupancy rather than average daily rate (ADR). It is a common phenomenon for occupancy to rebound first, before increased demand motivates hoteliers to raise their room rates.

Hotel performance

Due to additional factors in the operating environment, it will be interesting to monitor how hotel performance evolves in Manama throughout the remainder of 2019. A clampdown on unlicensed apartment accommodations by local authorities, mainly around the Seef and Juffair area, and the reduction of the 5 percent government levy applied to hotel guests’ bills has also helped maintain momentum for the sector. As a result, Manama hotels closed Q1 2019 with an actual occupancy of 58.4 percent, ADR of BHD59.80 and RevPAR of BHD34.90. Q1 comparisons this year were also helped by the calendar shift of the Bahrain Formula 1 Grand Prix moving from April 8 in 2018 to March 31 in 2019.

Opportunities in the market

There is currently a plethora of developments in Manama which should help further diversify and bolster tourism demand in the long term. A new airport terminal scheduled to be completed in October is expected to increase annual passenger- handling capacity to 14 million from the current total of 9 million. Moreover, mixed-use developments such as the Dilmunia and Marassi Galleria projects are underway. The man-made Dilmunia Island is aiming to become a prominent tourism and hospitality destination with a focus on health and wellness. Major elements that have already been announced are the Grand Canal and Marina, a number of residential districts and the Mall of Dilmunia. The Marassi Galleria is expected to provide additional themed urban developments with extensive hospitality and commercial facilities, along with a waterfront shopping mall. With this additional infrastructure underway, Bahrain is aiming to enhance its tourism offering and better position itself in the ever-changing regional and global tourism landscape. In terms of outlook, if the existing momentum is successfully utilised and tourism stakeholders concentrate efforts to sustainably stimulate tourism demand, Bahrain hotel performance could continue on a growth trajectory.