Covid-19 has impacted every sector of the economy. Mansoor Ahmed, director (MENA) for Healthcare, Education and PPP at Colliers international, talks revival and the role of wellness tourism as travel restrictions are gradually lifted and hotels begin to reopen.

Based on a report issued by the World Tourism Organization (UNWTO) in May 2020, international tourist arrivals dropped by 22 percent in Q1 2020 compared to the same period in 2019. This signals a potential decline of 60 to 80 percent for the whole year and translates into a loss of 67 million international arrivals and about USD 80 billion in receipts globally. The report also forecasts that up to 120 million direct tourism jobs are at risk. Indeed, 2020 has marked the worst performance for international tourism since 1950, putting an abrupt end to a 10-year period of sustained growth.

Based on the survey conducted by Colliers MENA Hotels team in April 2020, 79 percent of hotel owners in the MENA region decided to partially or fully close their hotels due to low occupancy rates and 54 percent of respondents expect the market to take about six to 12 months (from the start of recovery) to return to 2019 occupancy levels.

Even once the travel restrictions are lifted, travelers will have to adapt to a new “normal,” which will require Covid testing, social distancing and many other practices and policies.

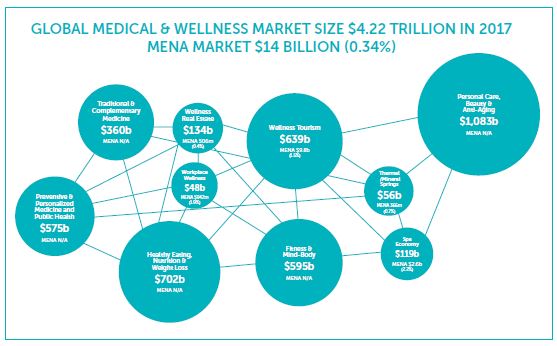

The Global Medical & Wellness Tourism Market

An important factor is to understand that wellness tourism is different from and larger than medical tourism, as presented below:

Global tourism: USD 5.3 trillion in size and 11.9 billion total trips.

Global medical tourism: USD 70 – USD 80 billion in size and 14 – 16 million total patients/trips.

Global wellness tourism: USD 639 billion in size (projected to increase to USD 919 billion by 2022) and 830 million total trips.

Based on latest available data, global market size reached USD 4.22 trillion by 2017, representing a growth of 12.8 percent from 2015 to 2017. To revive the MENA’s travel, tourism and hospitality sectors, governments, private investors and operators will be required to look beyond traditional medical tourism and spas. They will need to offer a wide range of services that encompass healthcare and wellness services (highlighted below) to attract local, regional and international tourists and achieve sustainable recovery and growth.

Back to basics

On 28 May 2020, the UNWTO released a set of guidelines to help the tourism and hospitality sectors emerge stronger and more sustainably from Covid-19. The UNWTO guidelines highlight “the need to act decisively to restore confidence and, as UNWTO strengthens its partnership with Google, to embrace innovation and the digital transformation of global tourism.”

The guidelines provide both governments and businesses with a comprehensive set of measures designed to help them open tourism up again in a safe, seamless and responsible manner.

Highlighting the importance of restoring the confidence of travelers through safety and security, the UNWTO protocols and the guidelines are designed to reduce risks in each step of the tourism value chain. These protocols include the “implementation of check procedures where appropriate, including temperature scans, testing, physical distancing, enhanced frequency of cleaning and the provision of hygiene kits for safer air travel, hospitality services or events.”

Win-win partnerships

Based on an in-depth experience in the MENA, Colliers believes that provision of tertiary care healthcare facilities offering minimal care in case of emergencies will further boost the confidence of travelers.

For hub cities, such as Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo, tour and hotel operators can forge links with local hospitals that are known to provide excellent care.

For resorts outside the main cities, similar to the coastal resorts in Egypt, Jordan, Oman, the UAE and more recently KSA (Red Sea Project, Qiddiya Entertainment City and Amaala Red Sea Riviera), hotel operators may have to join forces to provide and the support facilities. This may take the form of shared capital cost to establish a suitable healthcare facility. To improve profitability, the facility would also serve the permanent catchment population as well as tourists and those owning holiday homes.

Another option for the establishment of healthcare facilities could be Public Private Partnerships (PPP), where such facilities are considered as “public good” and governments provide regulatory and financial incentives to attract private investors and operators.

To make the tertiary care hospitals more profitable and hence attractive to investors and operators, other health and wellness “packages” could be offered as part of “tourism packages.” These have an additional positive impact on tourism and hospitality sectors as wellness tourists can often extend their stay.

Typical wellness packages would include beauty, cosmetic, weight loss, fitness, diet and nutrition, rehabilitation (trauma, accident and mental health) and other health-driven wellness treatments.

Conclusions

The health and wellness sector can act as a catalyst to revive travel, tourism and hospitality in the MENA, especially in the UAE, KSA and beyond. The introduction of health and wellness services is expected to not only revive travel, tourism and hospitality but also provide sustainability to the sector by offering concepts identified in the report, which require both domestic and international tourists to stay from a few weeks to several months rather than just days.