A ‘club deal’ is a term that investors have likely come across in financial publications from time to time but not paid much attention to. HN spoke with Aaron Allen, founder and chief strategist at Aaron Allen & Associates, one of the leading global restaurant strategy firms, to highlight this intriguing investment scheme.

A ‘club deal’ is a term that investors have likely come across in financial publications from time to time but not paid much attention to. HN spoke with Aaron Allen, founder and chief strategist at Aaron Allen & Associates, one of the leading global restaurant strategy firms, to highlight this intriguing investment scheme.

M&A deals: Cross border investments

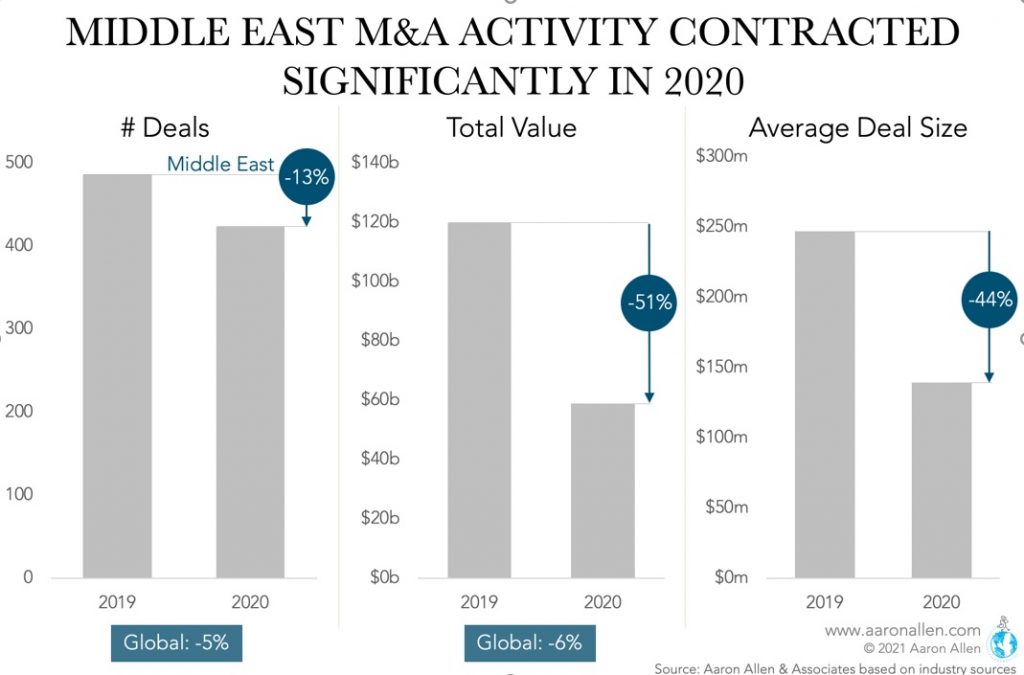

In the Middle East, M&A activity (across sectors) started to bounce back towards the end of last year. Throughout 2020, there were close to 420 deals completed, and most of the activity (two-thirds) was cross-border, with a lot of regional investments being made to fortify positions and gain economies. The average deal size shrank 44 percent (from USD 246M in 2019 to USD 139M in 2020), reflecting valuation cuts and the sale of distressed assets.

Club deals: What you should know

Club deals: What you should know

Club deals in the Middle East are not quite as common as in the U.S. or other geographies (yet), but with the economy rebounding as the region starts to leave the pandemic behind and restrictions begin to ease, alternative ways to invest (including Club Deals) can be advantageous to pick up larger companies at competitive prices.

A Club Deal is a relatively straightforward investment approach, where investors pool their money to acquire a controlling or large stake in a business. This structure has been around for some time but has gained traction among private market investors in the past few years in lieu of the traditional investment fund model.

Some of the best deals don’t see the light because of factors that are eliminated by club deal approach, so it’s easy to see why some investors might find this structure attractive. This includes lower fees, greater control over the deal terms and risk diversification benefits. We also believe these structures can be beneficial to the investment target as well, including bringing in a diversified group of investors that doesn’t necessarily dilute cap tables and the ability to develop value creation strategies that aren’t constrained by fund lifespans or return objectives.

Aaron Allen

By partnering with industry experts on club deals, investors can also save time and money while expanding the reach and efficacy of their capital. Club deals led by industry experts allow investors to tap into their investment theses, diligence, value creation plans, and networks without eating up their budgets. Over time, it can give access to larger deals as well.

Below, we’ll examine the pros and cons of a club deal and how this deal structure might maximize value for everyone involved, including co-investors, company management, and founders. We’ll also look at some of the drawbacks of a club deal, but also how working with the right partner can help to alleviate pain points.

Benefits of a restaurant investment club deal

Transparency and control

Investors know what they’re getting with club deals as opposed to an investment fund, where a sponsor/GP raises funds from institutional investors (LPs) and other high-net-worth individuals. Fund investors won’t have access to the same information that the GP does, and could have capital locked-in for an extended period of time. Club deal investors, on the other hand, generally have a say on specific deal terms while deciding how much to invest in a given deal.

Lower fees

Generally speaking, club deals offer lower fees than if investors chose to invest in an investment fund. Most investment funds have a traditional “two and 20” fee structure, where the manager charges a two percent fee on the assets under management in the fund, and a 20 percent performance fee when a fund reaches its objectives. Club deal economics can vary widely, but many do not charge a management fee (though the manager/lead investor may charge the deal group a fee when the deal closes). In cases where a fee is charged, it’s typically based on invested capital and well below the two percent fee charged by investment funds.

Risk diversification

Club deals allow smaller investors to collectively make larger investments they could not afford individually while spreading the risk among the group. Another way to think of this is would you rather own a single restaurant location (where your investment would likely be wiped out if the location closed) or a chain (where investor capital would likely withstand a single restaurant unit closer)? When combined with deal structure flexibility, we believe a club deal structure can offer investors ways to manage risk.

Potential downsides of a club deal

Coordination

As anyone with a family can attest to, getting groups of individuals to agree on anything can be a challenge. A club deal is no different, and coordinating a group of investors for individual deals is one of the major stumbling blocks. But the right partner can leverage its network when acting as sponsor and syndicate a deal with other investors and put together a comprehensive value creation plan.

Investment time frame

Because club deals often involve non-liquid assets, it may take time to build to an exit transaction, so investors have to manage expectations regarding investment timelines and realized returns. However, with access to industry executives and the ability to develop value creation plans, there’s potential for club deal targets to show rapid improvement, thereby reducing the time required before exploring exit transactions.

Deal access

There is a lot of capital chasing deals right now, making it difficult to find attractive deals at reasonable valuations. This is true for club deals, where smaller investors may not have access to the same deals as an investment fund. (AACP, for instance, has a proprietary pipeline in the foodservice industry, and we’re fortunate to see potential deals well before other capital providers, with wide enough variety to satisfy any investor looking to put money into the foodservice industry).